property tax assistance program calgary

3 2020 City Council approved 30 million in tax relief for Calgary businesses who have experienced the most significant municipal property tax increases over the past four years. Box 3100 Edmonton AB T5J 4W3 800-642-3853 seniorsgovabca.

The Seniors Property Tax Deferral Program allows eligible senior homeowners to voluntarily defer all or part of their residential property taxes including the education tax portion.

. The combined total income from line 15000 for all adult household members is required. Apply for property tax assistance. Box 2100 Station M Calgary AB T2P 2M5.

Property tax assistance program Property tax assistance. Your payment automatically comes out of your. Drop-off at one of our in-person.

Related

2020 - City Council approved 30 million in tax relief for Calgary businesses who have experienced the most significant municipal property tax. This is a development server and. All information submitted for property tax assistance is handled in a confidential manner.

You may qualify for individual programs such as a Recreation Fee Assistance and Calgary Transit Low Income Transit Pass Program or household programs such as Property Tax Assistance Program Seniors Services Home Maintenance Program or No Cost Spay Neuter Program. The City of Calgary Property Tax Assistance Program Property tax Offered to all low- income homeowners experiencing financial hardship. Under The Citys Property Tax Assistance Program residential property owners of any age may be eligible for a creditgrant.

If you qualify Seniors Property Tax Deferral Program will pay your residential property taxes directly. Apply by mail fax or drop-off. Property tax assistance program Property tax assistance.

Anyone who is approved will receive an additional rebate from Waste and Recycling Services. The 2022 property tax bill due date is June 30. Official web site of The City of Calgary located in Calgary Alberta Canada.

Have experienced an increase in property tax from the previous year. A creditgrant of the increase on the property tax for eligible low-income Calgarians. Personal information is collected in accordance with Section 33c of the.

The City of Calgary Property Tax Assistance Program Property tax Offered to all low- income homeowners experiencing financial hardship. 800 Macleod Trail SE Calgary Alberta T2G 2M3 Telephone. Scroll sideways to see the full table.

Due to the large volume of referrals applications will be processed in 4-6 weeks. Property tax bills cover the calendar year. Own the property for a minimum of one year from date of purchase.

Senior citizens over 65 years of age are eligible for Property Tax Assistance for Seniors Program which offers rebates of tax increases based on 2004 tax. Property owners who have not received a tax bill by the first week of June can request a copy of the bill by visiting property tax document request. All information submitted for property tax assistance is handled in a confidential manner.

Fair entry low income assistance. The City of Calgary Property Tax Assistance Program Property tax Offered to all low- income homeowners experiencing financial hardship. Resettlement Assistance Program Independent youth letter a letter from school principal guidance counsellor or Child and Youth Support Program of Alberta Childrens Services Canada Revenue Agency.

A creditgrant of the increase on the property tax for eligible low-income Calgarians. Meet the residency and income guidelines of the Fair Entry Program. This is done through a low-interest home equity loan with the Government of Alberta.

For more information about our programs visit property tax or Tax Instalment Payment Plan TIPP call 311 or 403-268-CITY 2489 if calling from outside Calgary. If there is insufficient space to list all the registered property owners and to make the necessary declarations on the front of this School. Get vaccinated and be.

Property Tax Assistance Program This is an annual program that provides a creditgrant of the increase in property tax for your property. In order to ensure that property taxes are directed correctly it is important that all property owners are designated on the School Support Notice and that the percentage of ownership adds up to 100. Personal information is collected in accordance with Section 33c of the.

Apply by mail fax or drop-off. Property Tax Assistance Program The City of Calgary PO. The Seniors Property Tax Deferral Program previously partnered with Alberta Treasury Branches to administer approved loans.

For more information about our programs visit property tax or Tax Instalment Payment Plan TIPP call 311 or 403-268-CITY 2489 if calling from outside Calgary. The Tax Instalment Payment Plan TIPP is a popular program that allows you to pay your property tax on a monthly basis instead of making one payment in June. The approved 2020 Non-Residential Phased Tax Program PTP will cap eligible property owners non-residential.

Official web site of The City of Calgary located in Calgary Alberta Canada. Own your own home and reside in your home. The City of Calgary offers a variety of property tax payment options to pay The City directly or through your bank.

7 penalty is added to any unpaid tax bill balance. 2020 Municipal Non-Residential Phased Tax Program PTP On Feb. Box 2100 Station M Calgary AB T2P 2M5.

Own no other City of Calgary residential property. Complete and sign the Fair Entry application form or large print version and then submit by. Education Property Tax Assistance for Seniors PO.

Drop-off at one of our in-person. Complete and sign the Fair Entry application form or large print version and then submit by. The 2022 property tax bill due date is June 30.

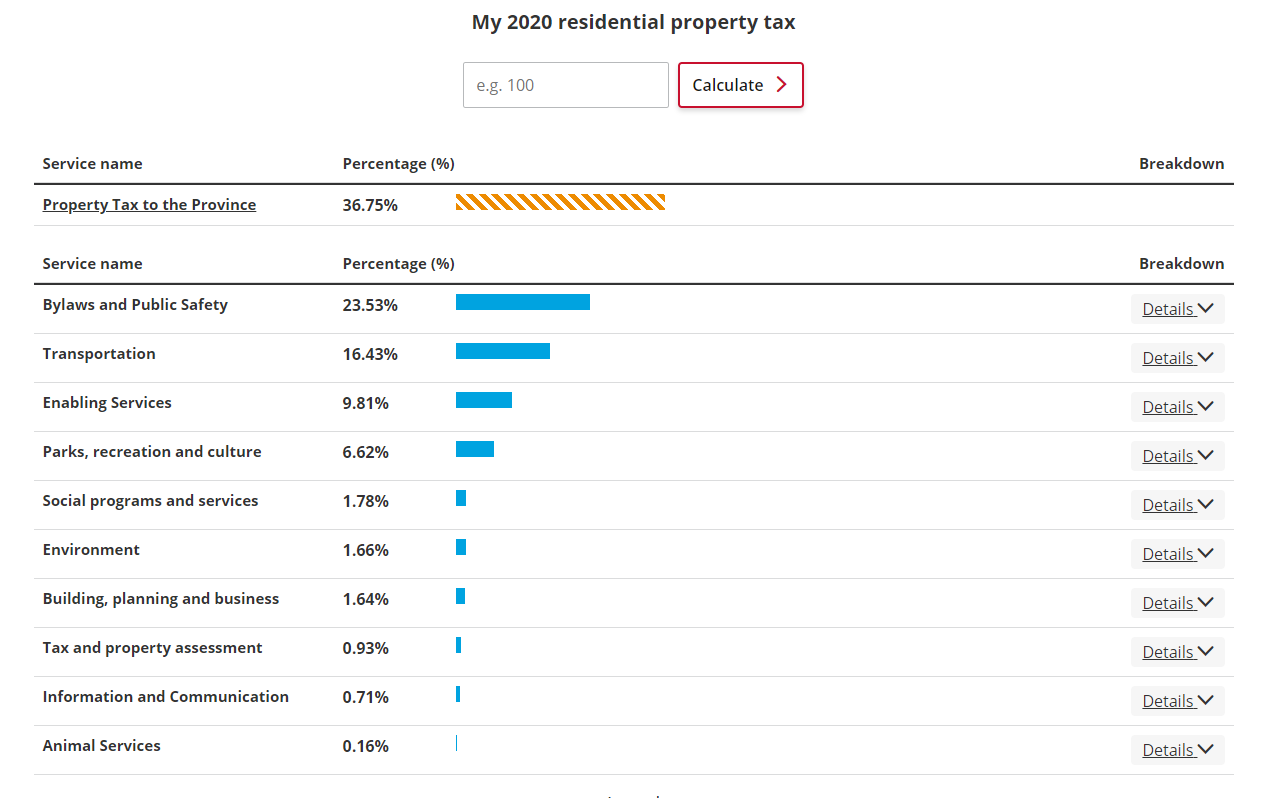

Bylaws and public safety. Apply now through Fair Entry and your one. The process assesses your income eligibility for multiple city programs.

Credit cards cannot be used to pay property tax. You can find more information at calgarycaptap calgarycafairentry or by calling 311 or 403-268-CITY 2489 if calling from outside Calgary. Masks are required on Calgary Transit.

Box 2100 Station M 8113 Calgary AB T2P 2M5 403-268-2489 calgaryca. The Municipal Emergency Plan remains activated to respond to the COVID-19 pandemic.

Ogden Community Updates Ward 9 Great Neighbourhoods Calgary Gian Carlo Carra

More Than 18m Unclaimed As Manitoba Education Property Tax Auto Insurance Rebate Cheques Go Uncashed Cbc News

Calgary Business Tax Long Term Solution Sought For Complex City Problem Livewire Calgary

Ogden Community Updates Ward 9 Great Neighbourhoods Calgary Gian Carlo Carra

More Than 18m Unclaimed As Manitoba Education Property Tax Auto Insurance Rebate Cheques Go Uncashed Cbc News

City Of Calgary Projects 400m In Revenue Losses Without Financial Support Ctv News

How To Fill Out Your Tipp Agreement

City Of Calgary Audit Reveals 147m Surplus Raising Questions About How To Spend It Ctv News

Intergovernmental Corporate Strategies

Calgary Real Estate Lawyer Explains Necessary Steps To Closing Transactions